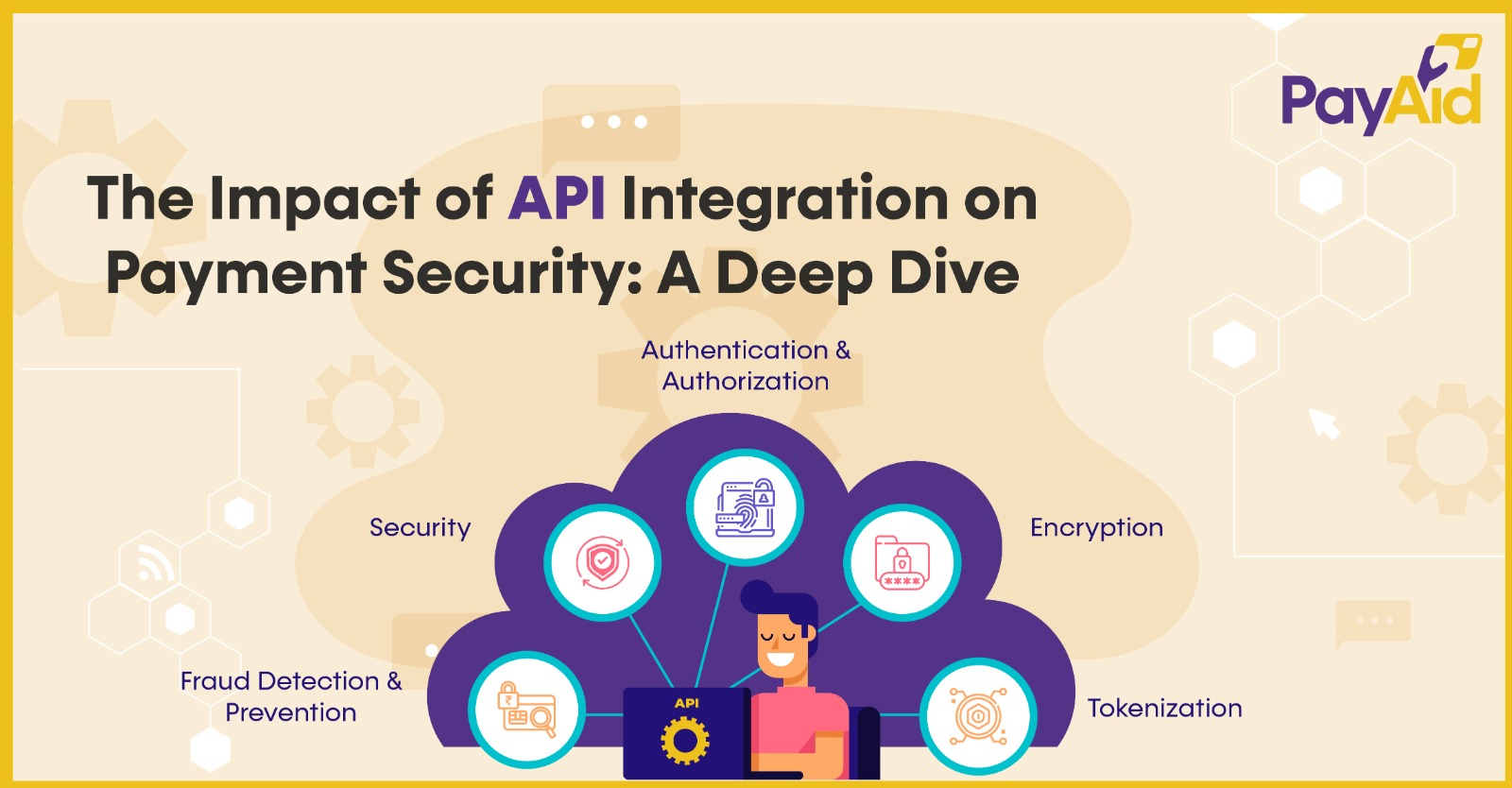

In today’s digital age, where online transactions have become the norm, payment processes’ security is paramount. Businesses are concerned about the safety of their financial information during every transaction. This is where API integration plays a pivotal role. In this deep dive, we will explore the profound impact of API integration on payment security, understanding how it safeguards sensitive data and ensures peace of mind for all parties involved.

Before delving into the impact on payment security, let’s briefly understand what API integration entails. API, or Application Programming Interface, serves as a bridge between different software systems. It enables them to communicate and share data seamlessly, ensuring the smooth flow of information between various platforms. Regarding payments, API integration enables businesses to connect their websites, mobile apps, or other digital platforms with payment gateways, facilitating transactions securely and efficiently.

Payment security is non-negotiable. Customers entrust businesses with their financial details, and any breach of this trust can have severe consequences. Protecting sensitive information such as credit card numbers, bank account details, and personal identification is essential to maintain this trust.

One of the foremost ways API integration enhances payment security is through encryption. API integration ensures this data is encrypted when a payment request is transmitted from a customer’s device to the payment gateway. This means that even if a malicious entity intercepts the data during transit, it remains unreadable and useless to them. Encryption protocols like SSL/TLS provide an extra layer of security, making it highly challenging for cybercriminals to decipher sensitive information.

API integration allows businesses to implement robust authentication and authorization mechanisms. Before any payment is processed, the system verifies the legitimacy of the user. Multi-factor authentication, biometrics, and secure tokens are some methods to ensure that only authorised individuals can initiate and complete transactions. This significantly reduces the risk of fraudulent activities.

Payment security is further bolstered by tokenization. When a customer makes a payment, their credit card information is replaced with a unique token. This token is then used for the transaction. Even if this token is intercepted, it holds no value outside that transaction. The card details remain securely stored, reducing the risk of data exposure.

API integration ensures that payment gateways stay up-to-date with the latest security patches and protocols. This proactive approach helps potential security threats before they can be exploited. Regular updates also ensure compliance with industry standards, making the entire payment process more secure.

Advanced AI and machine learning algorithms integrated into payment gateways via APIs can detect unusual patterns or behaviours that may indicate fraud. These systems can analyse real-time transactions and flag any suspicious activity for further investigation. This rapid response helps prevent fraudulent transactions from being processed.

The Trust Factor

The impact of API integration on payment security extends beyond technology. It fosters a sense of trust between businesses and their customers. When consumers know that their financial information is protected through robust security measures, they are more likely to engage in online transactions.

API integration is vital in ensuring businesses adhere to stringent payment security regulations. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) is essential for safeguarding sensitive data. API integration helps streamline meeting these compliance requirements, minimising the risk of non-compliance penalties.

PayAid’s API Integration is the cornerstone of secure and trusted transactions for merchants. Robust encryption protocols and cutting-edge security measures ensure that sensitive data remains shielded from any potential threats. This instils confidence and empowers merchants to transact with peace of mind. PayAid’s commitment to safety extends beyond the transaction, offering real-time monitoring and fraud detection systems to identify and mitigate risks proactively. With API Integration, merchants can embrace a future of secure, seamless, and worry-free transactions, knowing that PayAid has their back every step of the way.

In an era where digital payments are becoming increasingly prevalent, the security of these transactions is paramount. API integration emerges as a critical component in safeguarding payment processes. It ensures that sensitive data is encrypted, authentication is rigorous, and fraudulent activities are promptly identified and prevented. Beyond technology, API integration fosters trust and ensures compliance with industry regulations. It’s not just a technological innovation; it’s a guardian of financial integrity in the digital age. Businesses prioritising API integration are not just ensuring payment security but also securing their customers’ trust and loyalty.

Comments are closed.

Coming soon: Spend funds from your Ceve wallet at 46 Million merchants and ATMs worldwide. Can it get any easier than that? Just Grab The feature!!!

Flat Number 101, Second floor

H.No.7-1-75, Sree Sree Towers

D.K Road Ameerpet Hyderabad, Telangana, 500016.

Can you explain the role of Payment Integration Services in simplifying online payments?

Payment Integration Services play a crucial role in simplifying online payments by bridging the gap between businesses, customers, and financial institutions. These services facilitate the seamless and secure transfer of funds over the internet, enabling businesses to accept payments for products and services. Here’s how they simplify online payments:

1. Multiple Payment Methods:

Payment integration services support various payment methods such as credit/debit cards, digital wallets, UPI, BQR, bank transfers, and even EMI & BNPL. By offering multiple payment options, businesses can cater to a wider range of customers, enhancing convenience and increasing sales.

2. Global Reach

3. Security and Compliance

4. User Experience

5. Real-Time Processing:

6. Mobile Payments:

7. Analytics and Reporting:

8. Support and Maintenance:

In summary, payment integration services simplify online payments by providing secure, diverse, and user-friendly payment options. They empower businesses to expand globally, enhance customer satisfaction, and focus on their core operations, leaving the complexities of payment processing to experts in the field.